Kenya, a nation renowned for its vibrant tech scene and burgeoning mobile money adoption, is increasingly piqued by the allure of cryptocurrency. Bitcoin, the digital gold standard, naturally commands significant attention. But amidst the hype and promise, a fundamental question lingers: Is Bitcoin mining profitable in Kenya? This inquiry necessitates a meticulous examination of the hardware costs involved, alongside a broader understanding of the Kenyan crypto landscape.

At its core, Bitcoin mining is a computationally intensive process. It’s essentially a global race where individuals or entities, known as miners, compete to solve complex mathematical problems. The first to crack the code gets to add the next block of transactions to the Bitcoin blockchain and is rewarded with newly minted Bitcoin. This reward incentivizes miners to maintain the integrity and security of the network. But this race demands specialized hardware, and that’s where the cost hurdle looms large.

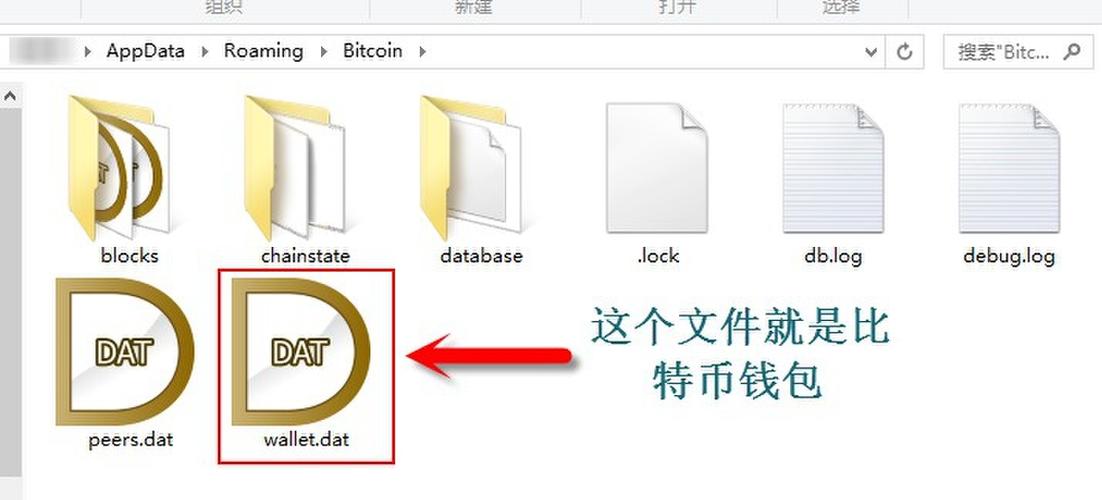

The primary weapon in a Bitcoin miner’s arsenal is the Application-Specific Integrated Circuit, or ASIC miner. These machines are purpose-built for hashing, the computational process at the heart of Bitcoin mining. They’re incredibly powerful, but also incredibly expensive. A single, modern ASIC miner can easily cost thousands of US dollars. The price fluctuates based on its hashing power (measured in terahashes per second, TH/s) and energy efficiency (measured in joules per terahash, J/TH). The more TH/s a miner offers, the more chances it has to solve the cryptographic puzzles. The lower the J/TH, the less electricity it consumes, which directly impacts profitability.

Kenya’s electricity costs play a crucial role in determining mining profitability. Compared to countries with heavily subsidized energy rates or access to cheap renewable sources, Kenya’s electricity prices can be a significant drain on a miner’s earnings. A high electricity bill can quickly negate any potential Bitcoin rewards, rendering the entire operation unprofitable. Miners must carefully calculate their energy consumption and costs before investing in hardware. Exploring alternative energy sources, such as solar or geothermal, could potentially offset these expenses and boost profitability.

Beyond the cost of the ASIC miners and electricity, there are other expenses to consider. These include the cost of setting up the mining infrastructure, such as cooling systems to prevent the miners from overheating, networking equipment to ensure a stable internet connection, and physical security to protect the equipment from theft. These ancillary costs can add up quickly and should not be overlooked when assessing the overall profitability of Bitcoin mining.

The difficulty of Bitcoin mining is constantly adjusted to maintain a consistent rate of block creation (approximately every 10 minutes). As more miners join the network, the difficulty increases, making it harder to solve the cryptographic puzzles and earn Bitcoin rewards. This means that miners must continuously upgrade their hardware to remain competitive. Older, less efficient miners become obsolete and contribute to electronic waste. This constant need for upgrades further increases the capital expenditure required for Bitcoin mining.

The price of Bitcoin itself is, of course, a major determinant of mining profitability. If the price of Bitcoin rises, miners earn more revenue for each block they solve. Conversely, if the price of Bitcoin falls, miners earn less revenue, which can quickly turn a profitable operation into a losing one. This volatility adds a layer of risk to Bitcoin mining, as miners must try to predict the future price of Bitcoin to make informed investment decisions. The fluctuating exchange rates between Bitcoin and the Kenyan Shilling also contribute to this price-related uncertainty.

An alternative to purchasing and operating their own mining hardware is to engage in cloud mining or mining pool participation. Cloud mining allows individuals to rent hashing power from a remote data center, eliminating the need to purchase and maintain their own equipment. However, cloud mining contracts can be expensive and often come with hidden fees. Mining pools allow miners to combine their hashing power and share the rewards, increasing their chances of earning Bitcoin. However, joining a mining pool also means sharing the rewards with other miners, which can reduce individual profitability.

For those seeking a more diversified approach within the crypto sphere, alternative cryptocurrencies like Ethereum (ETH) and Dogecoin (DOGE) present different mining landscapes. Ethereum, while transitioning to a Proof-of-Stake consensus mechanism (reducing the need for traditional mining rigs), still offers opportunities for GPU mining of other Ethereum-based tokens. Dogecoin, with its Scrypt algorithm, can be mined using less specialized hardware, although the rewards are typically lower. Exploring these alternative mining options can be a strategic way to mitigate the high costs and risks associated with Bitcoin mining.

The regulatory environment surrounding cryptocurrency in Kenya is still evolving. While the Central Bank of Kenya has cautioned against the use of cryptocurrencies, there is a growing recognition of their potential for innovation and economic development. Clearer regulations would provide greater certainty for miners and investors, potentially attracting more investment into the Kenyan crypto space. The legal status of Bitcoin mining operations, including taxation and licensing requirements, remains a key factor in determining the long-term viability of mining in Kenya.

In conclusion, the profitability of Bitcoin mining in Kenya is a complex equation with many variables. The high cost of hardware, coupled with Kenya’s electricity prices and the ever-increasing mining difficulty, presents significant challenges. While opportunities may exist for those who can secure access to cheap renewable energy or participate in cloud mining or mining pools, a thorough cost-benefit analysis is essential before embarking on a Bitcoin mining venture in Kenya. The future of Bitcoin mining in Kenya will depend on factors such as technological advancements in mining hardware, changes in electricity prices, the evolution of the regulatory environment, and, of course, the fluctuating price of Bitcoin itself.