In the rapidly evolving landscape of cryptocurrencies, the allure of mining has drawn countless enthusiasts and investors alike. Yet, diving into crypto mining is far from a simplistic endeavor; it demands precision, strategy, and a comprehensive understanding not only of the digital currencies but also of the machinery that powers the operation. From Bitcoin’s notorious hash rates to Ethereum’s shift toward proof-of-stake, miners find themselves navigating a complex ecosystem where knowledge is power and efficiency is king.

At the heart of any profitable crypto mining venture lies the mining rig—an ensemble of specialized hardware engineered to solve cryptographic puzzles that validate blockchain transactions. Modern installations predominantly utilize ASIC (Application-Specific Integrated Circuit) miners for Bitcoin, known for their unparalleled computational power and energy efficiency. However, when mining altcoins such as Ethereum, GPUs (Graphics Processing Units) retain their utility, striking a delicate balance between hash rate and cost. The choice between these machines significantly impacts not only profitability but also the long-term sustainability of the mining project.

Hosting mining machines has surged in popularity as a pragmatic solution for miners seeking to bypass logistical headaches. By entrusting their rigs to third-party data centers equipped with robust electricity supply and optimized cooling systems, miners can mitigate risks associated with hardware maintenance and fluctuating energy costs. This strategy dovetails perfectly with the increasing centralization of mining farms, which deploy vast arrays of miners to exploit economies of scale and maximize returns.

Bitcoin mining farms, often situated in regions with affordable electricity or renewable energy sources, exemplify this trend. These farms are not mere aggregations of mining rigs but finely tuned ecosystems engineered for peak performance. From ambient temperature control to real-time monitoring, cutting-edge facilities ensure operational continuity and shield investments from volatilized market conditions. This level of protection is paramount as cryptocurrency valuations can swing dramatically, influencing mining rewards and operational expenses.

The complexity deepens when considering multi-coin mining strategies. Enthusiasts often evaluate the fluctuating market capitalizations and transaction fees of various cryptocurrencies—be it Bitcoin, Dogecoin, or Ethereum—to optimize their portfolio of mined assets. Dogecoin, initially conceived as a meme coin, has manifested genuine utility over time, boasting increased transaction speed albeit with a lower hash difficulty compared to Bitcoin. Ethereum’s transition to Ethereum 2.0 heralds major shifts in its mining paradigm, prompting miners to reevaluate the balance between hardware obsolescence and emerging yield opportunities.

Miners are continuously assessing the efficacy of their investment, weighing variables such as hash rates, block difficulty, and electricity costs. The decision to deploy mining rigs in-house versus opting for hosting services hinges on these calculations. Hosting offers scalability and reduced overhead, ideal for newcomers or large-scale operations unwilling to manage physical infrastructure. Conversely, self-managed rigs can provide greater direct control, especially when miners capitalize on intermittent renewable energy sources or capitalize on off-peak tariffs.

Exchanges play an integral role, serving as the bridge between mined assets and market liquidity. Sophisticated traders track price actions of Bitcoin, Dogecoin, Ethereum, and other altcoins, strategically timing their conversions to maximize profit. Many exchanges now support instant swap facilities and wallet integrations that streamline the flow from mining yield to active portfolio management. Consequently, miners must not only master the technical side of rig deployment but also navigate the financial intricacies of crypto markets.

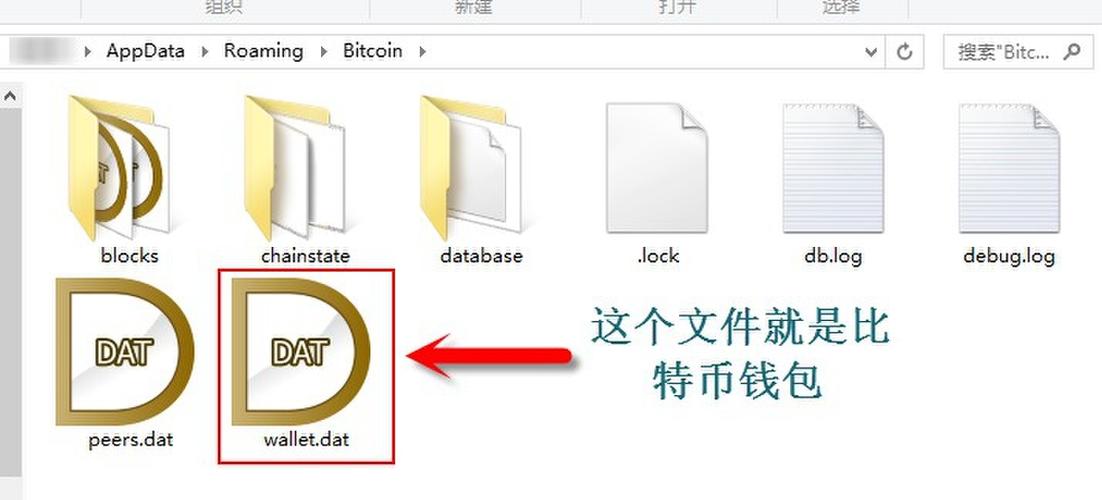

Security considerations are equally critical. Protecting mining rigs from cyberattacks, hardware malfunctions, and even physical theft are essential elements in maintaining operational integrity. Solutions range from encrypted network protocols to advanced physical locks and surveillance systems, ensuring that miners’ investments remain impervious to external threats. Additionally, the environmental impact and regulatory compliance increasingly factor into the strategic planning of mining operations, with many farms adopting green energy to align with sustainability goals and legal mandates.

In essence, embarking on a profitable and protected crypto mining venture is a multidimensional challenge. Success is achieved not merely by chasing block rewards but by orchestrating a symphony of technological prowess, financial acumen, and risk management. By intelligently investing in mining rigs, leveraging hosting services, and remaining adaptable amid the stochastic nature of cryptocurrencies, miners can aspire to carve out a formidable presence in the digital gold rush—one that is resilient, lucrative, and forward-thinking.